Lawyers spend far too much of their valuable time chasing after unpaid invoices instead of working billable hours. Being able to schedule payments in advance provides both you and your clients with unmatched convenience, and helps ensure steady cash flow for your practice. This type of system is only convenient, however, if it’s able to run automatically, without you or someone from your office having to re-collect and re-enter credit card information every time a transaction runs.

Lawyers spend far too much of their valuable time chasing after unpaid invoices instead of working billable hours. Being able to schedule payments in advance provides both you and your clients with unmatched convenience, and helps ensure steady cash flow for your practice. This type of system is only convenient, however, if it’s able to run automatically, without you or someone from your office having to re-collect and re-enter credit card information every time a transaction runs.

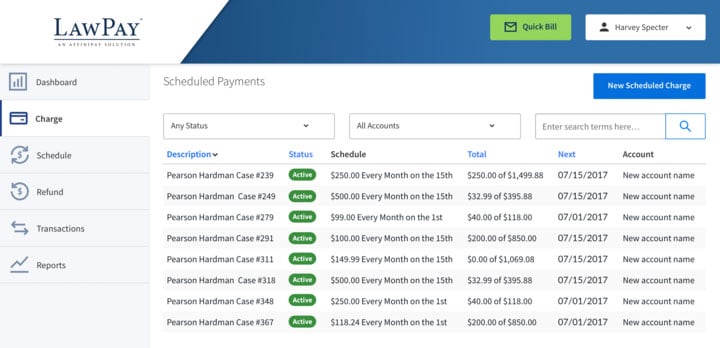

With LawPay’s Scheduled Payments feature, client credit card information is stored in their secure, online card vault, and charges run at the frequency and interval that you and your client establish. This ensures that your invoices get paid automatically and when you expect, helping you build a predictable and steady cash flow for your firm. Additionally, because LawPay stores and protects all of your clients’ payment information, you can keep that sensitive data out of your office.

Setting up Scheduled Payments in your LawPay account only takes a few minutes and allows you to establish both one-time and ongoing future charges. You can also see all of your scheduled transactions in the Scheduled Payments section of your account, giving you an easy and reliable way to predict future cash flow.

Adding Scheduled Payments

LawPay has three separate plans you can choose from based on the unique needs of your practice. Whether you are using their fixed, standard, or trust plan, you can activate Scheduled Payments on your account for free.

About LawPay

LawPay is proud to be recommended by 47 state bars, trusted by 40,000 firms, and the only payment solution offered through the ABA Advantage program. Developed specifically for the legal industry, LawPay’s complete end-to-end payment system manages the unique needs of law firms by providing a solution that correctly separates earned and unearned fees, ensuring you don’t co-mingle funds when you accept credit card payments. Additionally, their system protects lawyers’ IOLTA accounts against any third-party debiting, so you can rest easy trusting your transactions to LawPay.

SPONSORED CONTENT. Product Spotlight showcases content provided by Attorney at Work sponsors and advertisers. This does not constitute endorsement by Attorney at Work. See Terms and Conditions for more information.