Were you a little surprised that you had to write yet another check for taxes? Here’s what you need to know about your revenue, compensation and law firm profits.

Table of contents

’Tis the Season for Tax Payments

’Tis the season for … heart-stopping conversations with your tax accountant. Lawyers are often caught off guard when the accountant comes to them in April and says, “You owe $$$$.” The question that goes through their head is, “How can I owe money if there wasn’t any cash left in my account at the end of the year?”

This is usually followed by some concern about where they are going to get the money.

Let’s start with the first question: Why do you owe taxes when there wasn’t much cash left in the firm’s business account at the end of the year?

What Counts as Profit?

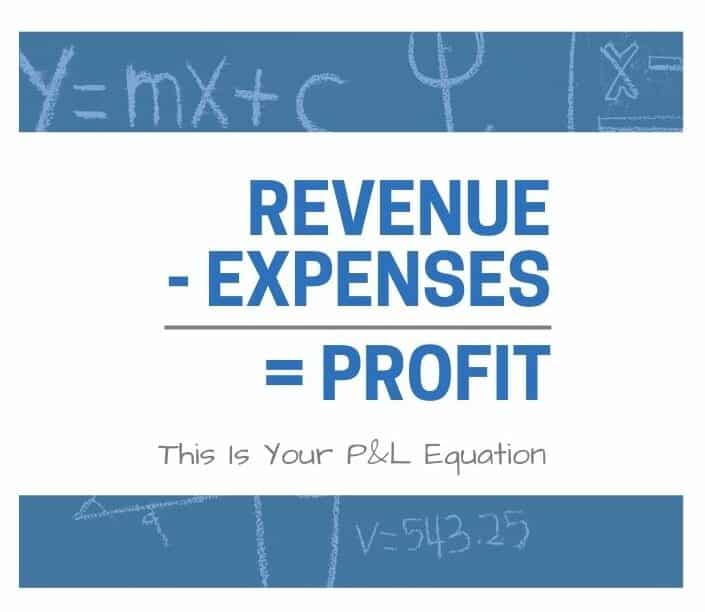

Here is the equation for your P&L:

Profit is the number the Internal Revenue Service uses to calculate your annual taxes. We suggest looking at your profit number each month and setting aside money for taxes. Here’s the thing: The IRS is always going to get its pound of flesh, so you might as well plan for it. Your tax accountant can tell you what percentage you should tuck away for tax payments, and when to make estimated tax payments throughout the year.

How Should You Divide Your Law Firm Profits?

That leaves the rest of the profit to be divided. This is a struggle many partners encounter. One part of your law firm profits needs to be segregated into an account that is set up as a “war chest” while the rest gets distributed to the owner or owners.

And that’s a fine balance. There always seems to be one partner who wants to plow all the money back into the firm to grow. And there is often another partner who wants to distribute all the profit. Neither is wrong — the answer is somewhere in the middle.

Filling the War Chest

Your firm is probably the biggest asset and definitely the biggest wealth creator you have in your life.

Having money sitting in an account, ready to deploy as opportunities arise, is what will help create that wealth.

Good uses of war chest cash include new marketing initiatives or, if you work on contingency, you can use your war chest to fund cases.

If you mostly work on an hourly basis, contingency cases that can secure your retirement probably only come along a few times in your career.

I ran my family’s law firm before I started my company — I was basically the CFO. My father had a few of these big contingency cases come along — it’s why he holds the highest jury verdicts ever awarded in multiple counties in Texas. As a corporate litigator. But financing those cases, which can take years — especially when you factor in all the appeals — is really hard. Having cash in a war chest to cover the loss of hourly billing is huge.

And those huge cases bring me to what you do with the rest of the money.

Paying Out Law Firm Profits

We advise our clients to keep half the profit in their war chest and distribute the rest. What gets distributed doesn’t show up on your P&L.

Especially with those big judgments, you need to take care of yourself and your families. Pull the money out of the firm and invest it. Use it for retirement.

And that brings me back to my family’s story. When my father and brother won that big case and it paid out, they took cash OFF THE TABLE. It means my brother can retire — and he’s only 45. He has secured his future.

As the owner of the firm, you should be properly compensated for the time, energy and risk you are putting into the firm.

Total Owner Compensation Is the Number to Watch

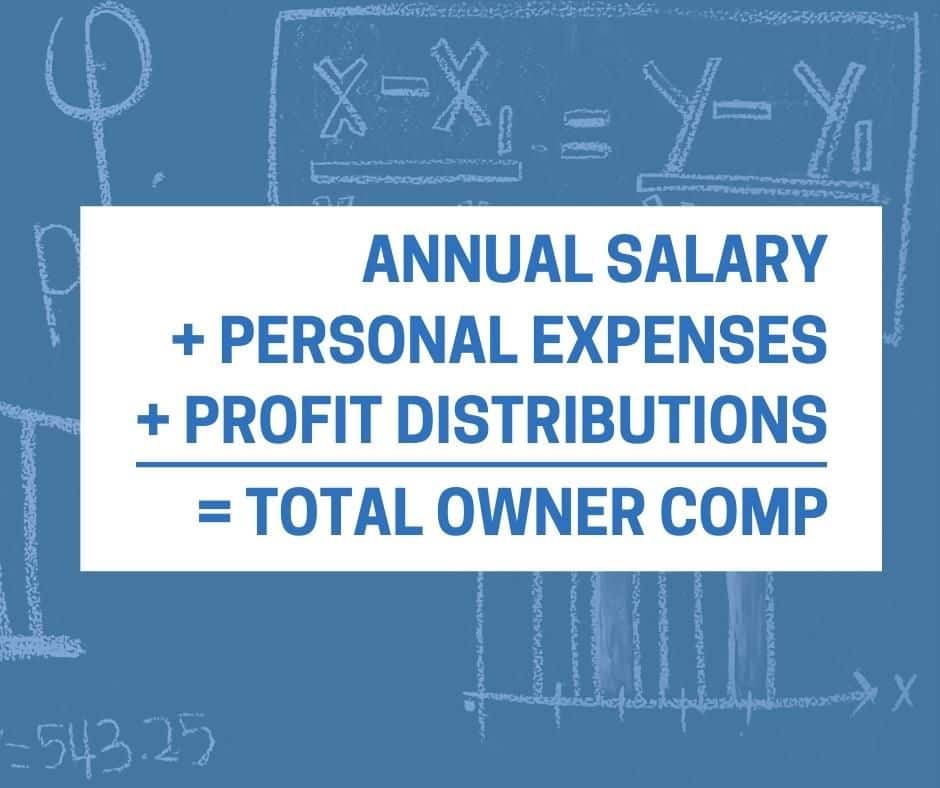

Be aware that there is a difference between the profit you distribute and total owner compensation.

Total owner compensation is all the benefit you get from your firm — and that is the most important number.

Your total owner comp for the year is made up of a few categories:

- The salary you get for working in your firm.

- All the personal expenses you run through the firm. (No judgment, we all do it. As long as your CPA is fine with it, so are we.)

- The profit that is distributed.

Depending on the size of your firm, you want total owner compensation to be between 35% and 70% of firm revenue. See the chart below for exact percentages.

Are you getting that much? Do you even know?

OWNER COMP PERCENTAGE OF REVENUE

| Revenue Range | $ – to $250,000 | $250,000 to $500,000 | $500,000 to $1,000,000 | $1,000,000 to $5,000,000 | $5,000,000 to $20,000,000 |

| Owner Comp | 70% | 60% | 50% | 35% | 35% |

Four Ways to Manage Your Law Firm Profits

None of you opened your own firm or became a partner in an established firm to not make money.

Here are four things you can do to impact your law firm profits and your total owner compensation:

- Tax payments. Talk to your accountant and establish a reasonable percentage that should be put in a separate tax account based on the profit each month. That way, you are ready to write the check at tax time — no matter how big or small.

- War chest. Put an agreed amount of profit in a separate account, make a list of great uses of cash, and then marry up the two.

- Distributions. Monitor your profit. Is it rising or falling? Does it satisfy your needs?

- Owner benefit. Do the math and figure out how much you are actually benefiting from your firm.

Keep your eyes on these four things and next year, the tax time news from your accountant won’t be such a jolt.

Illustration ©iStockPhoto.com

Subscribe to Attorney at Work

Get really good ideas every day for your law practice: Subscribe to the Daily Dispatch (it’s free). Follow us on Twitter @attnyatwork.