So it’s August, and you are sitting down to reconcile your bank accounts for July’s activity. This is an exercise you do every month (or should be doing). As long as there’s money in the checking account, life is good, right? Maybe. But it begs the question: Is your law practice profitable — and can it do better?

Understanding which key metrics you should be tracking and measuring is critical to remaining profitable as a solo and small firm attorney. This time of the year, with half the year’s numbers in the books, is a good time to evaluate the numbers on your “financial dashboard” before plowing through the rest of the year.

Are You Profitable? 10 Things to Ask Yourself

First, step back and review where you are in relation to your total annual budget for 2014. You say you never created that budget? No worries. This article will help you plan ahead and get a budget and a system in place.

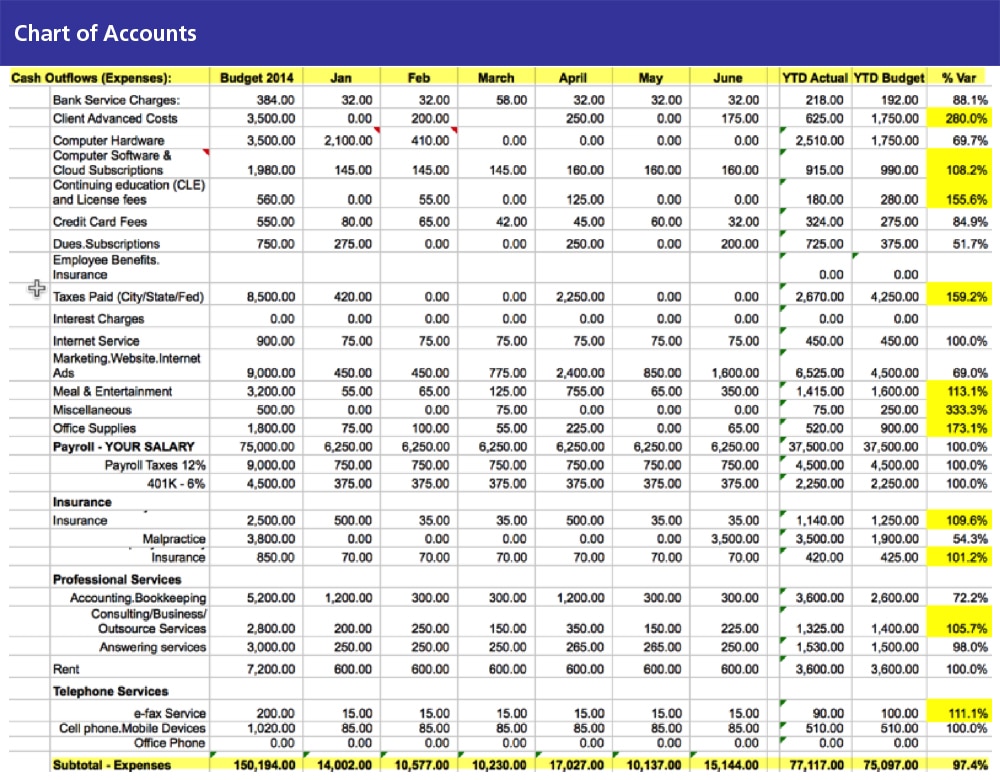

Here’s a sample budget tracker spreadsheet to start with now, and here’s a sample spreadsheet of the key metrics you should be tracking on your “financial dashboard.”

Now, let’s ask a few questions to get you in the mindset of looking at your firm as a business.

1. Are you paying yourself a monthly salary? Is it enough to cover your personal expenses? Or are you randomly taking money out of the business when the bank account looks healthy enough to do so?

Goal: Build your salary into your budget along with payroll taxes. While it is tempting to take out money as needed, the tax implications for this habit will catch up with you in the next year. Figuring this into your firm’s budget requires you to create a personal budget, so you know how much salary you need to cover your family’s monthly bills (and save for your kids’ college and your retirement).

Payroll (Your Salary) – $75,000

Taxes 12% – $9,000

401K 6 % – $4,500

2. Do you know what you have to bill and collect every month to cover your firm’s monthly expenses, including your salary? This is your monthly “nut” – the amount you will need every month to pay fixed expenses. Knowing this amount assumes you know your monthly fixed expenses.

Goal: Calculate your “monthly nut.” Put this number in a very visible place — it is your reminder that once you hit this number, you are making profit for your family and your future retirement.

$13,000 Monthly Nut = Income Required to Break Even Each Month

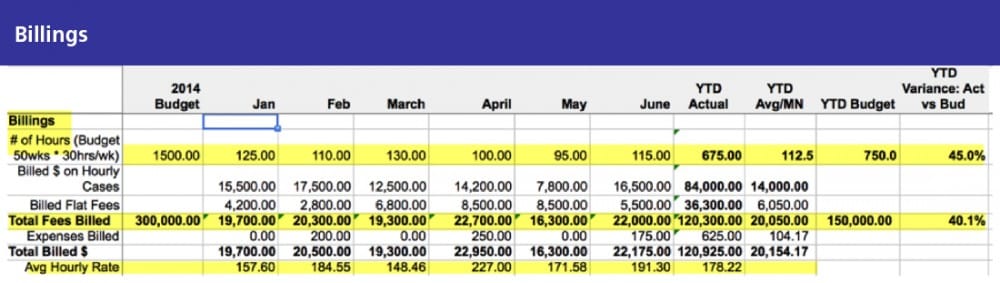

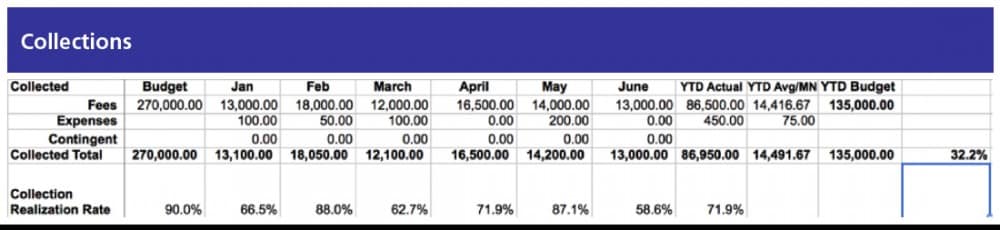

3. Does your budgeted income number reflect your collection realization rate? If you budget to bill 1,500 hours per year at $200 per hour, your budgeted revenue is $300,000. But it’s not a perfect world and this is not what you will collect. Knowing your collection realization rate will help you set a realistic revenue number to drive your budget.

Total Revenue

1,500 Hours * $200 Per Hour * 90% Realization Rate = $270,000

Goal: Calculate your YTD 2014 collection realization rate. Shocked at how low it might be? A collection realization rate of 90% should be an attainable goal. If it seems daunting based on how low your current collection rate is, don’t worry. This is one area of your financial dashboard that you can improve on by changing billing habits and better tracking accounts receivable.

4. Do you know your year-to-date profit or loss? How do your actual numbers compare to what you budgeted? A profit and loss statement is sometimes referred to as an income statement. It is simply an accounting report comparing income to expenses, usually shown monthly compared to last month for the same time period. Having a budget to review each month is invaluable for tracking expenses — you may not think you are spending a lot of money until you see it in writing monthly.

Goal: Make sure your accounting system is set up with a chart of accounts that segregates expenses by categories you wish to track. Every month, enter the actual amounts spent and watch for unusual trends. If one month was higher than usual, adjust for the remaining months so you don’t overspend.

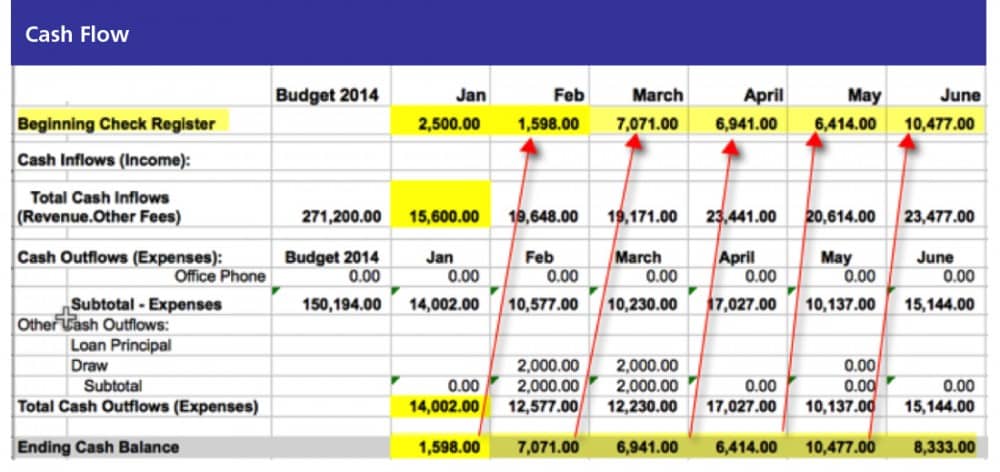

5. Do you have a cash flow report you can look at every month? A cash flow report is a way for you to keep an eye on your actual checking account balance. If you are reconciling every month and updating your financial tracker spreadsheet, you will know how much you are starting with every month — with enough money in the checking account or not enough. This report gives you data to make decisions about your business so you can be proactive, not reactive.

In the sample budget tracker spreadsheet, the beginning cash balance for the next month is calculated this way:

Beginning check register balance

+ Cash inflow (revenue/income)

– Cash outflow (expenses)

= Ending month’s check register balance (match to bank statement) and next month’s beginning check register balance

Goal: Commit to reconciling your bank accounts within the first few days of each month and updating your budget/financial tracker spreadsheet with the reconciled amount. Having current data is essential for making good business decisions.

6. How many hours and dollars are you billing each month, and what is your average hourly rate? You can’t get paid unless you are billing every month. Knowing how much you are billing every month, and what the trends are, will help you see your financial future — not through rosy glasses, but in actual numbers.

Goal: Track your billable hours and bill promptly and regularly. Train your clients to expect to pay monthly for their legal services.

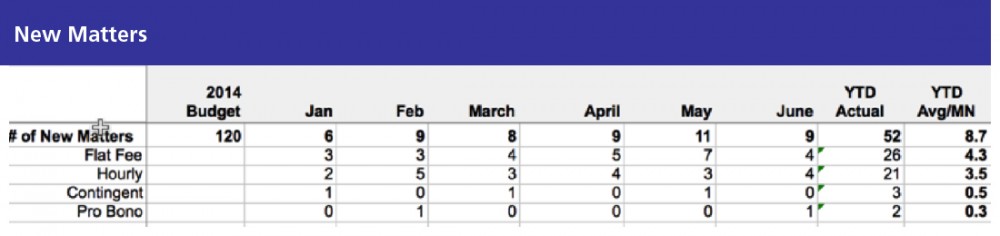

7. How many new matters are you setting up each month, and what has been the trend? Is the pipeline full for continued cash flow? Do you have an even balance of hourly vs. flat fee vs. contingent?

Goal: Track the number of new matters per month and visualize the growth. A month with a low number of new matters can signal less income in the coming months — especially combined with a low beginning check register balance. Knowing this ahead of time can help you prepare. For example, you might look closely at expenses over the upcoming months and defer some if possible.

8. What is your six-month collection realization rate? Is this a weak spot and a reason for low revenue numbers? Your collection realization rate is the percentage of your billed fees that is actually collected. Pretty simple stuff. Collection realization rates are often overstated because lawyers tend to leave uncollectible receivables in the system for an unrealistic time period, rather than admit the money will never be collected.

Goal: Calculate your six-month collection realization rate, and for the remainder of the year, set a goal to increase this by 2 percent. An increase like this can yield additional money without doing more work.

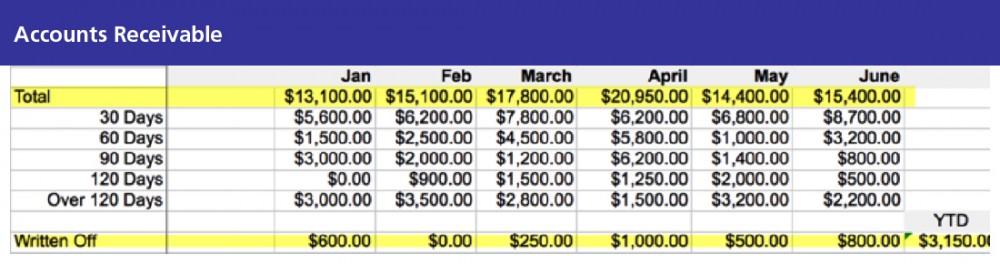

9. What are your outstanding accounts receivables in the categories of 30, 60, 90 and over-90 days? You can find additional profit for your firm, without putting in longer hours, by simply tightening up or putting in place good receivables management practices. Set expectations with your clients early on regarding timely payment of invoices. You are a small business owner and cash flow is critical.

Goal: Implement monthly billing procedures and collect all payments before they hit 90 days past due. Create a procedure to send letters requesting payments once an account hits 60 days past due and follow up regularly. Analyze past-due accounts in excess of one year. They have little chance of being collected, so don’t count on getting the money. Write if off and move on.

10. Don’t have a budget or method to track your firm’s financial data? Build yourself a nice spreadsheet so you are ready for the rest of 2014. This is an invaluable exercise, and once it’s done, the spreadsheet easily converts to an annual worksheet.

Peggy Gruenke is Chief Operating Officer at Hengehold Capital Management, as well as a law firm management specialist in operations, online marketing, technology and accounting at LegalBizSuccess. Peggy is active in the ABA GP Solo Division, a frequent ABA TECHSHOW speaker and she writes on productivity and profitability for Attorney at Work. Read more or her articles here.

Illustration ©ImageZoo.