If you can’t easily understand exactly where your money goes, here’s advice from a law firm accounting expert on setting up your books so you get clearer reports.

Key Takeaways

- Accuracy is Key: Accurate accounting is vital for law firms to be financially stable, compliant and to make informed decisions. It helps to find cost savings, manage cash flow and plan for growth and ultimately drive the firm to long term success.

- Customize Your Financials: Law firms should customize their financial statements (e.g. profit and loss) to get a clear view of their financial performance. By categorizing expenses and using law firm accounting software firms can be more efficient and compliant.

- Choose Your Accounting Method: Law firms need to choose an accounting method that suits their financial management and regulatory needs. Cash basis accounting is simple but may not fully reflect the firm’s financial performance so it’s important to tailor the accounting method to the firm’s circumstances.

For law firms, having the right business bank accounts is key. Personal and business finances should be separate to ensure that bookkeeping is accurate and compliance is maintained.

Beyond specialized accounts like IOLTA, a business checking account plays a fundamental role in effectively managing client funds within a legal practice.

Most small and solo law firms are working with financial statements that don’t give them the information they need to make informed business decisions.

Understanding Law Firm Accounting

What is Law Firm Accounting?

Law firm accounting is the detailed process of managing a firms finances, including recording, classifying and reporting of financial information. This involves tracking income, expenses, assets, liabilities and equity to ensure financial statements are accurate and compliant with regulatory requirements. Good law firm accounting is key to a firms financial health and success. It allows lawyers and administrators to make informed decisions on resource allocation, budgeting and financial planning.

Why Accurate Accounting Matters for Law Firms

Accurate accounting is the foundation of financial stability for law firms. It’s compliance and decision making. Inaccurate accounting means financial mismanagement, non compliance and potential reputational damage. By keeping accurate records and financial statements law firms can be transparent and accountable. This precision helps identify cost savings, cash flow and make decisions about growth and development. In short accurate accounting isn’t just about balancing the books it’s about steering the firm to long term success.

Law Firm Accounting Challenges

Law firms face many accounting challenges from managing client funds to tracking complex transactions. One big one is compliance with regulatory requirements especially around trust accounts and IOLTA (Interest on Lawyers’ Trust Accounts). Law firms also need to manage cash flow, accounts receivable and accounts payable to be financially stable. Implementing and maintaining accounting systems can also be tricky especially when choosing the right legal accounting software. These challenges highlight the need for a solid accounting framework to navigate the complexities of legal financial management.

Choosing an Accounting Method

Cash Basis for Law Firms

Cash basis accounting is the most popular method for law firms because it’s easy. Under this method, revenues and expenses are recognized when cash is received or paid, not when earned or incurred. This gives a clear picture of a law firm’s cash flow and makes day to day financial management easier. But cash basis accounting doesn’t always reflect a law firm’s financial performance as it doesn’t account for accounts receivable or accounts payable. Law firms must choose an accounting method that suits their financial management needs and complies with the regulatory requirements.

The Off-the-Shelf Law Firm P&L

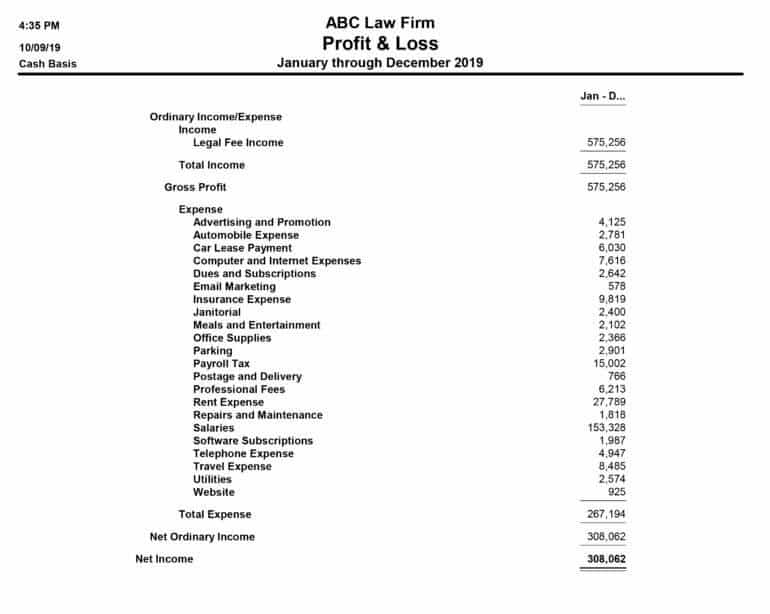

To illustrate, I’ve created a mock P&L that exemplifies what I often see when I first look at a firm’s books.

In the profit and loss statement above — created using only the default QuickBooks expense categories — the bookkeeper has not customized the expense categories at all. Instead, she has used the standard chart of accounts provided by QuickBooks. Each financial transaction should be categorized into assets, liabilities, or equity to maintain accurate bookkeeping and prevent errors. (Instructions about how to modify your chart of accounts are provided at the end of this article.)

What a Standard QuickBooks P&L Won’t Tell You About Cash Basis Accounting

Using the P&L above, can you answer the following questions about the two largest expenses for law firms — occupancy and personnel expenses?

- How much does this firm spend on personnel, all in (wages, workers’ comp insurance, employee benefits and other perks)?

- Similarly, how much does this firm’s office space cost them in total, including rent, utilities, janitorial, visitor parking?

Unfortunately, you cannot easily answer the questions using the information presented in the sample P&L. Indeed, not only can’t you answer the questions after a quick glance at the P&L, but you won’t even be able to answer them by spending a few minutes with the report and your calculator. This is because the default expense categories employed in this P&L are configured in a way that obfuscates that information. For example, the insurance line lumps together health insurance, workers’ compensation insurance, and E&O coverage. Thus, it effectively hides health insurance and workers’ comp costs.

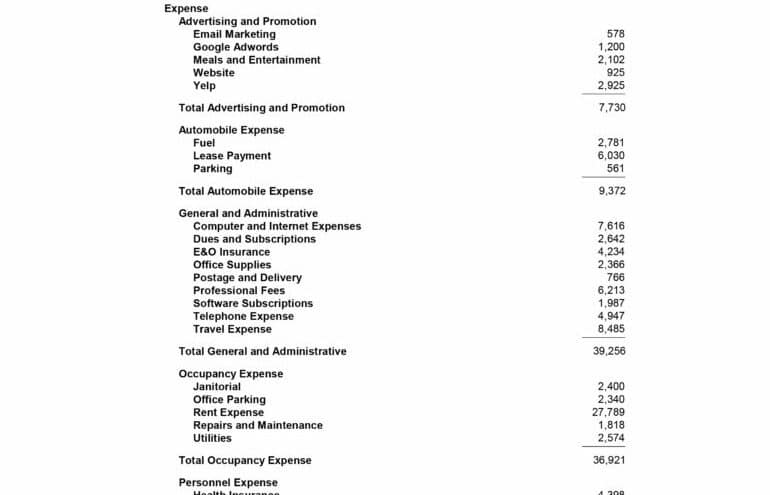

A Customized Law Firm P&L

In contrast, let’s take a look at another P&L — this one customized by me to provide the law firm’s principals with clear and meaningful information about its business. A firm’s accounting is key in providing this clear and meaningful financial information, helping to avoid common mistakes and maintain compliance.

Can you answer the questions (1) How much does the firm spend on personnel and (2) How much does the firm’s office space cost them? Yes! And you can answer them easily, with one quick look at the financial statement. Law firm accounting software can automate bookkeeping tasks and ensure adherence to regulatory standards, enhancing efficiency and compliance.

The reason is that the second example employs two simple strategies that organize the same expenses in a much more informative way:

- “Parent” accounts are created to organize similar expenses into broad and understandable categories.

- Insurance is divided into logical subcategories such as health and workers’ comp insurance (a personnel expense) and professional liability insurance.

These simple modifications to your accounting records are quick and easy, and they will give you a great deal of clarity, especially about the expenses your firm is incurring.

Law Firm Accounting Guidelines to Help You Do This for Your Own Firm

Start thinking about the broad categories of expenses you want to track. Whether you are using QuickBooks or another accounting program, I suggest the following:

- Personnel expense. If you have staff, you know that salaries are just one part of the true cost of employing people. As you’re setting this up, think hard about all the other ways you spend money on human capital. Did you use a search firm or recruiting website during your employee search? Are you paying benefits? All of these costs should be captured so that you can see the entire cost of your personnel.

- Occupancy expense. For most firms, this is the second-largest ongoing expense. Naturally, you’re going to place rent expense here, but don’t forget the other expenses you incur as a result of being in your particular space. Perhaps you have to pay the parking garage separately for employee parking, and for those pricey parking validation stickers. Do you have a janitorial service, a plant service, utilities? Include them. The rule of thumb is to ask yourself, would I still have this expense if I didn’t have this particular office?

- Advertising and promotion. This is probably the only line item that you’ll want to look at from a perspective of return on investment (ROI). Even if you’re not matching the precise income you’ve gained to each different advertising or promotional dollar you’ve spent, you’ll still want to look at this number closely. Subdivide this expense category in any way that makes sense to you. I have a client who has expense sub-accounts titled “Avvo,” “Google AdWords” and “Yelp” because he spends money each month on those services.

- Automobile expense. Most small and solo law firms run at least some of their automobile costs through the business as a way to maximize allowable tax write-offs. The reason to use subcategories here is to split out parking expenses and tolls, which are deductible at 100% percent. This will help your CPA during tax prep.

- General and Administrative. This broad category captures all the costs you incur in the running of your business that cannot be neatly pigeonholed into one of the other categories.

Law Firm Accounting Software: Simplify Your Finances

Law firm accounting software is a specific tool designed to cater to the financial management needs of law firms. These go beyond general accounting software by having features specific to the legal industry like trust accounting, time tracking and matter management

Benefits of Law Firm Accounting Software.

Using dedicated law firm accounting software can simplify your practice’s finances in many ways:

- Compliance: These systems are designed to help law firms comply with legal accounting rules including trust account management and IOLTA

- Time: By automating many accounting tasks such as invoice generation and expense tracking law firm software can save you time that can be spent on client matters

- Accuracy: Automated systems reduce the risk of human error in data entry and calculations so you get more accurate financial reporting

- Integration: Many law firm accounting solutions integrate with other practice management tools so you get a seamless workflow from client intake to billing and payment

- Reporting: These platforms have robust reporting features so you can generate custom financial reports that give you a clear view of your firm’s financials

What to Look For When choosing law firm accounting software.

- Trust accounting

- Time and expense tracking

- Matter based billing

- Integration with legal practice management software

- Customizable reporting

- Cloud access for remote work

By using the right law firm accounting software you can have control over your finances, comply and make better business decisions based on real time financials.

Insist on Clarity in Financial Statements for Law Firms

Your P&L statement should be tailored to your specific business needs. Don’t let your accountant or bookkeeper use generic expense line items. Instead, insist on clarity and usability in your financial statements. If you can’t easily understand exactly where your money goes, you need to revamp your books.

Extra: Click here to download PDF instructions on how to modify your QuickBooks chart of accounts.

1016 | Illustration ©iStockPhoto.com