Follow this checklist to pass a trust account audit and reduce your risk of disciplinary action for mishandling client funds. Note: The new State Bar’s Client Trust Account Protection Program (CTAPP) conducts audit based compliance checks to ensure adherence to trust accounting rules.

Table of contents

- The Audit Process

- 1. Do you maintain a separate client ledger for each client’s money held in trust?

- 2. Does your invoice include an accounting summary of your client’s trust funds?

- 3. Do you accept credit card payments for retainers deposited into your IOLTA account? And if so, how do you account for the credit card fees?

- 4. Do you know what a three-way trust account reconciliation is and how to do one?

- 5. Where do you deposit flat-fee payments?

- Subscribe to Attorney at Work

Every lawyer knows mismanaging a trust account (IOLTA) can have terrible consequences. However, most lawyers receive little or no training in how to manage a trust account before opening one of their own. Law schools don’t address this in enough detail — at least based on the blank looks received when I mention trust accounting to new grads. And only the enlightened bar associations conduct a hands-on, mud-up-to-your-elbows trust accounting class for all new lawyers. (I think they need to turn it up a notch and get a little muddier.)

Megan Zavieh wrote here about the possibility of enforced random trust account audits in California. All of which begs the question, “Are your trust accounting practices sufficient?” The implementation of random audits as part of the Client Trust Account Protection Program (CTAPP) ensures compliance with trust account regulations.

The Audit Process

The audit process for trust accounts is key to compliance with trust accounting rules and client funds integrity. Here’s the lowdown:

When it comes to trust account audits preparation and knowledge are your friends. The audit process starts with a notification from the auditor, which could be your state bar association or another regulatory body. This will outline what’s being audited and what documents you need to produce.

Auditors will go through your trust accounts to make sure you’re following trust accounting rules. This includes checking that you have separate client ledgers, do three way reconciliations and record all transactions. They’ll also check that client funds aren’t commingled with your operating account and that credit card fees are accounted for.

During the audit you’ll need to produce detailed accounting records, including bank statements, client ledgers and reconciliation reports. Auditors will look for discrepancies such as negative balances or unexplained withdrawals which could indicate mismanagement of client funds.

The penalties for failing a trust account audit can be severe, from fines to suspension or disbarment. But by keeping good records and following the rules you can keep your law practice in compliance and your client’s trust funds safe.

In short, knowledge is power when it comes to trust account audits.

Mini-Checklist for Trust Account Management

If you are in doubt about being at risk for disciplinary action regarding the mishandling of client funds, here is a mini-checklist of items you can start implementing today.

1. Do you maintain a separate client ledger for each client’s money held in trust?

You’d better. Ethics rules require keeping an individual ledger for each client so specific funds can be identified. So make sure you have the ability to do this — even if it is only a simple spreadsheet. If you are not good at accounting or QuickBooks, there are great practice management software packages available today to help you manage these funds and stay in ethical compliance. Proper record-keeping is important so it can be reviewed during a random audit conducted by the State Bar.

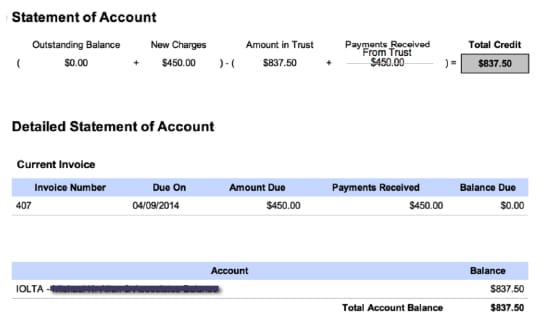

2. Does your invoice include an accounting summary of your client’s trust funds?

This is simple, and your practice management system should have this feature. You have a duty to notify your clients how and when you used their funds and to keep detailed and accurate records. Below is a sample of what you should be including on an invoice where client trust funds were used.

- Invoice detail of work performed (time entries), of course

- Total amount due (new charges)

- Amount applied to pay the invoice (payment)

- Remaining client trust balance

If your invoicing software does not allow you to create a custom invoice template like the one above, then you can attach a report called “client trust ledger report,” which is basically a spreadsheet showing all deposits and withdrawals and the current trust balance.

Best practice tip: After applying the trust funds to the invoice, send the client an updated invoice, which includes the amount of retainer applied and the balance remaining in trust. If the balance is zero or approaching zero, you should also include a letter requesting additional retainer money be deposited if you are anticipating more work to be done.

3. Do you accept credit card payments for retainers deposited into your IOLTA account? And if so, how do you account for the credit card fees?

Does your credit card company allow for credit card fees to be deducted from your operating account? If not, are you keeping a reserve in your IOLTA account to cover these fees and then properly recording them when entering the deposit? (Side note: This is the one exception to the rule regarding lawyers depositing their own funds into IOLTA accounts: It is acceptable for them to deposit their own funds into the IOLTA account to cover the payment of bank fees, including credit card fees.)

4. Do you know what a three-way trust account reconciliation is and how to do one?

A three-way reconciliation means that your IOLTA bank balance matches your checkbook trust balance and they both match the sum of all individual client ledger balances. Most accountants do not understand three-way reconciliations. That’s no excuse for your lack of understanding. You have fiduciary responsibilities and you cannot delegate this responsibility.

Here is a simple spreadsheet template you can download to use for a three-way reconciliation.

5. Where do you deposit flat-fee payments?

Not all flat fees are created equal. This fee may be deposited in the trust account until earned or, upon full disclosure and client consent (in your fee agreement), may be treated as earned upon receipt and deposited in the operating account. This is a common practice for criminal cases. In some states, even litigation tasks billed as flat-fee tasks and clearly communicated in your fee agreement can be earned upon receipt. Check your individual state’s ethics rules.

Best practice tip: Upon receipt of the money, create a flat-fee invoice, apply the payment and provide the client with a copy of the invoice.

If your flat fee is for work that involves multiple steps, like bankruptcy filings, then it is better to deposit the flat fee into a client’s trust account and withdraw when reaching specific events or milestones — again, as outlined in your fee agreement.The Trust Account Audit: One More Tip

This last tip actually came from an attorney who suffered through the Katrina disaster. On each check you receive that will be deposited into your IOLTA account, write on the memo line of the check: Client Name and Matter. Those may seem obvious to you now, but if a disaster struck and you had to re-create your IOLTA accounting records, there is no way you would remember this information.

The Trust Account Audit: One More Tip

This last tip actually came from an attorney who suffered through the Katrina disaster. On each check you receive that will be deposited into your IOLTA account, write on the memo line of the check: Client Name and Matter. Those may seem obvious to you now, but if a disaster struck and you had to re-create your IOLTA accounting records, there is no way you would remember this information.

Illustration © robuart/iStockPhoto.com

Subscribe to Attorney at Work

Get really good ideas every day: Subscribe to the Daily Dispatch and Weekly Wrap (it’s free). Follow us on Twitter @attnyatwork