Consider asking GenAI tools to analyze your legal writing for clarity — or to identify vague or potentially misleading language in another party’s documents.

The legal industry’s approach to using generative artificial intelligence (GenAI) is rapidly changing. On July 29, 2024, the American Bar Association issued its Formal Opinion 512. The opinion recognizes that lawyers are using AI for a variety of tasks and states that such use must conform to ethical rules. That includes situations where a lawyer must disclose to the client the use of AI, the role of a law firm supervisor, and time and costs billing issues.

In the aftermath of several scandals in which lawyers relied on AI hallucination research, some judges issued orders requiring disclosure of the use of AI or even prohibiting it. But then, recognizing the changing landscape of this uphill battle, at least one judge rescinded his order, and the Fifth Circuit declined to issue one.

When AI Analyzes Legal Writing

Even judges are turning to AI to help interpret documents. In his concurring opinion in Snell v. United Specialty Insurance Company, 11th Circuit Court of Appeals judge Kevin Newsom explained how he used AI to help him decide an insurance coverage case.

The issue was whether the remodeling job of an in-ground trampoline constituted “landscaping” within the meaning of a commercial general liability (CGL) policy. Almost all such policies in effect are forms from the Insurance Services Office, Inc., usually the multistate version. Newsom described checking how OpenAI’s ChatGPT, Google’s Gemini, and Anthropic’s Claude defined “landscaping.”

Judge Newsom reviewed the pros and cons of using AI LLMs (large language models). He concluded: “At the very least, it no longer strikes me as ridiculous to think that an LLM like ChatGPT might have something useful to say about the common, everyday meaning of the words and phrases used in legal texts.”

The CGL policy form has been around for a long time. As you would expect, it includes an extensive definitions section. I fed an excerpt to Chat GPT (see below) and asked it to identify any vague or potentially misleading language. Here’s the result:

To improve clarity, consider defining key terms explicitly in the policy, using straightforward language, and providing examples or scenarios where appropriate. This will help ensure that policyholders understand the terms and conditions of their coverage.

Not so helpful. Limiting and refining the query might have produced better results, but it would have been a time-consuming, complicated task with no guarantee of better guidance.

Get to the Point frequently preaches the importance of avoiding language that might be incorrect, vague or misleading. A basic maxim of document interpretation is to embrace the plain language of a document. Courts have long turned to dictionaries when statutes are vague and case law is contradictory. Newsom’s opinion embraces plain language and references lawyers’ and judges’ dictionary-centric approach.

Of course, you would never intentionally draft an ambiguous document, but what about when your job is to interpret the language in a document? Maybe AI can help in both situations.

Using AI Document Analysis

Consider feeding some of your legal writing to an AI large language model program. You could ask it to identify and improve any vague language. Free programs limit how many characters you can put in your query, but paid versions are inexpensive, at least for now.

Frankly, the results might be useless — or not. The ABA opinion stresses that generative AI is not a substitute for your professional opinion but merely a supplement.

Analyzing another party’s writing with an AI LLM program might produce interesting results. AI identification of ambiguous language may prompt you to dig deeper. That could mean revising contract language or challenging an opponent’s interpretation in a way you had not previously considered.

We are still learning AI’s potential, and that potential broadens as its use increases. As Judge Newsom suggests, don’t be afraid to take advantage of AI as a tool. Just don’t assume the results are the end of your research.

Here’s the definitions section I fed to Chat GPT:

1. “Bodily injury” or “property damage”

The terms “bodily injury” and “property damage” need to be clearly defined within the policy. Without clear definitions, the interpretation could vary.

2. “occurs during the policy period”

It might be unclear whether this includes injuries or damages that started before but continued into the policy period. The phrase “occurs during” could benefit from clarification regarding ongoing events.

3. “no insured listed under Paragraph 1. of Section II – Who Is An Insured”

This reference requires readers to consult another section of the policy. Ensuring that Section II is easily accessible and clearly defined is crucial to avoid confusion.

4. “authorized by you to give or receive notice of an ‘occurrence’ or claim”

The criteria for authorization should be clearly outlined. Who exactly is considered authorized, and what formalities are required for someone to be authorized?

5. “knew that the ‘bodily injury’ or ‘property damage’ had occurred, in whole or in part”

The phrase “in whole or in part” can be vague. It could benefit from clarification regarding what constitutes partial knowledge of an injury or damage.

6. “any continuation, change or resumption”

The terms “continuation,” “change,” and “resumption” are broad and could be interpreted in various ways. More precise definitions or examples could help clarify these terms.

7. “will be deemed to have been known prior to the policy period”

The phrase “deemed to have been known” is legalistic and might not be easily understood by all policyholders. Simplifying the language or providing a plain language explanation could be helpful.

8. “was not, prior to the policy period, known to have occurred by any insured”

The condition of being “not known” can be subjective. It might be beneficial to specify how knowledge is determined and documented.

9. “includes any continuation, change or resumption of that ‘bodily injury’ or ‘property damage’ after the end of the policy period”:

This statement could be confusing because it suggests that the policy might cover events occurring after the policy period under certain conditions. Clarifying the extent of coverage for post-policy events is essential.

Image licensed under Unsplash+

More Writing Tips

Find more good ideas for improving your legal writing and communications skills in “Get to the Point” by Teddy Snyder.

Subscribe to Attorney at Work

Get really good ideas every day for your law practice: Subscribe to the Daily Dispatch (it’s free).

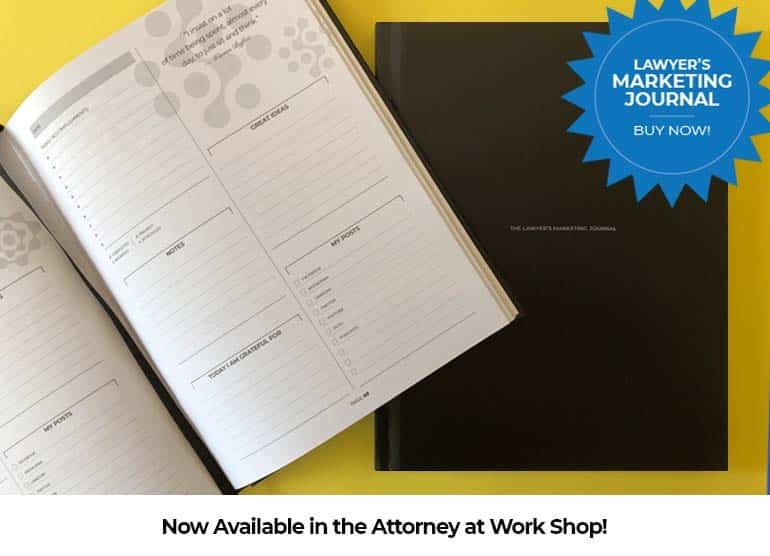

Lawyer’s Marketing Journal

Teddy Snyder, author of Women Rainmaker’s Best Marketing Tips, has designed a journal that is ideal for tracking marketing and BD activities, ideas and inspiration. Undated pages give you the flexibility to start today.