How are law firm owners paid? Salary? Draws? Pass-through expenses? Here’s how to track your total owner compensation so you’ll know if you are getting paid what you deserve — and what it really costs to run your firm.

Table of contents

- Law Firm Ownership Structures

- Accounting for Your Total Owner Compensation vs. Salary for Law Firm Owners

- Law Firm Compensation Models

- Keeping Tabs on Your Current Total Owner Compensation

- The Fix: Adjust Your P&L Statement to Show Your Total Owner Compensation

- Total Owner Compensation Is on a Sliding Scale

We get a lot of questions from law firm owners that go something like this:

- How much should I be spending on marketing?

- How much should I be spending on my people?

- How much should I be spending on … ?

What they’re really asking is this:

“How much should I be spending on other stuff in my law firm so I can know how much I should be getting?”

And it’s a great question: What should you be paid for the time, effort and risk you’re taking to be the owner of a law firm? This depends on whether you are an equity partner, who holds ownership stakes and is compensated through profit distributions, or one of the non equity partners, who are typically compensated with a salary.

Law Firm Ownership Structures

Law firms can be structured in many ways, each with its pros and cons. The most common are partnerships, S corporations and limited liability companies (LLCs). Law firm owners need to understand these different structures as they impact compensation, tax and overall business.

In a partnership structure, law firm owners are partners who share profits and losses. Partnerships can be general or limited. General partners have unlimited personal liability meaning they are personally responsible for the firm’s debts and obligations. Limited partners have limited liability meaning their personal assets are protected from the firm’s liabilities.

S corporations are another option. These are corporations that elect to be taxed as pass-through entities. Meaning the corporation’s income is only taxed at the individual level, avoiding the double taxation that comes with traditional corporations. This is good for law firm owners who want to minimize their tax burden.

LLCs combine the liability protection of corporations with the tax benefits of partnerships. This hybrid structure is flexible and protective and is a popular choice for many law firms. LLCs allow law firm owners to have limited liability and pass-through taxation.

When deciding on an ownership structure law firm owners should consider their business goals, tax situation and personal preferences. For example, partnerships may be good for small law firms with a few owners who want to share the responsibilities and profits. S corporations or LLCs may be better for larger law firms with multiple owners who want liability protection and tax benefits.

Accounting for Your Total Owner Compensation vs. Salary for Law Firm Owners

First, let’s look at how you get compensated because, unlike an employee, your total compensation doesn’t show up on your W-2. Most law firms are structured as partnerships, which greatly affects their tax reporting and obligations. This organizational choice leads to specific tax implications for partners, including the prohibition against issuing W-2 forms and the unique treatment of income and distributions under the Internal Revenue Code.

How are law firm owners paid?

Law firm owners generally get paid in three ways:

- Law firm owner salary. Yes, this is what is on your W-2.

- Draws, profit distributions, or guaranteed payments. Equity partners benefit from profit distributions, which are shares of the firm’s profits based on their ownership stake, while non-equity partners typically receive a fixed salary.

- Personal expenses run through the firm. Don’t deny it, most of us do it, and I really don’t care as long as your tax accountant feels comfortable filing your taxes.

Your total owner compensation is made up of these three items. So, when we talk about what you as an owner are getting paid, we’re talking about these three things.

Law Firm Compensation Models

Law firm compensation models can be very different and the right one for your firm depends on size, structure and goals. The most common models are lockstep, modified lockstep and eat-what-you-kill.

The lockstep model is the traditional approach that rewards seniority and experience. In this model partners are paid based on years of service with more senior partners getting paid more. This promotes stability and loyalty within the firm but may not always reflect individual performance.

The modified lockstep model is a variation that adds individual performance and contribution. While partners are still paid based on years of service they can also get bonuses or extra pay for outstanding performance. This model tries to balance the benefits of seniority with the need to reward high performers.

The eat-what-you-kill model is a more modern approach that focuses on individual performance and business development. In this model partners are paid based on the revenue they bring in, with more successful partners getting paid more. This model encourages partners to focus on business development and client acquisition but can also lead to partner conflict.

When choosing a compensation model law firms should consider their business goals, culture and values. For example a firm that values teamwork and collaboration may prefer a lockstep or modified lockstep model. A firm that prioritises individual performance and business development may opt for an eat-what-you-kill model. By aligning the compensation model with the firm’s priorities law firm owners can have a more cohesive and motivated team.

Keeping Tabs on Your Current Total Owner Compensation

The problem is this: During the year, most owners can’t tell what they’ve been paid or how much it’s really costing to run the firm, especially in relation to the firm’s profits.

While draws, distributions and guaranteed payments show up on your balance sheet, you have to do math to see how much the number has changed from month to month. What a pain!

And, let’s be honest, it’s hard to tell how much of the office supply expense was actual office supplies and how much was, say, those Nerf guns you got from Amazon. Or the difference between a plane ticket you bought to fly to a CLE and the one you bought to go away for spring break.

The Fix: Adjust Your P&L Statement to Show Your Total Owner Compensation

As a company, CathCap struggled with this for a while. Then we hit on a solution that makes accountants crazy, but really helps law firm owners understand their total owner compensation and how they are benefitting from their firm. How? We rearranged their P&Ls:

- We took all the expenses owners run through the business and recategorized them as “Other Expenses.”

- And we took the Draw/Distributions/Guaranteed Payments and did the same thing.

This one really makes accountants twitch because we are taking something that normally, traditionally and legally is a balance sheet item and moving it to the P&L. I’ll stop here for a moment while you call 911 to resuscitate your accountant.

Now your Profit & Loss Statement looks something like this:

Revenue | $1,000.00 |

Payroll | $300.00 |

Marketing | $100.00 |

Overhead | $200.00 |

Net Operating Income | $400.00 |

Draws/Distribution | $200.00 |

Owner Travel | $150.00 |

Owner Office Supplies | $50.00 |

Home Office Expenses | $20.00 |

Total Other Expenses | $420.00 |

Net Income | ($20.00) |

These changes show what it really costs to run the firm. (Your salary is still a payroll expense because if you weren’t there, they would have to pay somebody to replace you.) It also displays very clearly what you, as the owner, are taking out of the firm. In this case, as shown on the bottom line, it is more than you made in salary that month.

Equity partners, who have an ownership stake in the firm, also need to consider these financial implications, as their roles come with greater job security and financial responsibility. Rearranging the P&L also helps you avoid pulling too much out and “starving your firm,” which we discussed in a previous “Profits Over Panic “column.

There’s a phenomenon that seems to occur at the $1 million revenue mark, once a firm is finally turning a profit. We’ve noticed that owners start taking all the money out of the firm — and it is easy to see why. They haven’t been on a vacation, bought a new car, or done any house maintenance for years. Now that they are “successful” it’s time to do all those things. By taking so much money out, though, they are starving the firm of the cash it needs to continue to grow.

In the example above, you have actually taken out more than you made, which means your firm has taken on debt to pay you personally. Unless you rearrange your P&L as we do for our clients, it is very hard to see when you are starving your firm.

Now that you can see everything you are taking out of the firm, including profit distributions, let’s answer the question of how much you should be getting paid.

I’m going to use the most famous attorney phrase of all time: It depends.

Non-equity partners do not have the same job security as equity partners because they lack ownership stakes in the firm, which significantly affects their financial stability and decision-making power within the firm.

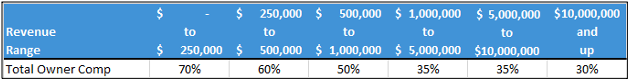

Total Owner Compensation Is on a Sliding Scale

The more you grow, the lower your percentage becomes. This is because in the beginning, when you are small, you do the vast majority of the work yourself, actively engaged in practicing law. So not only are you being paid to own the firm, you are being paid to grind out hours. As the firm grows, your job changes. You do less legal work and more marketing and management. Your contribution to the top-line revenue is still important, but it is a much smaller percentage. So the percentage you take out is also smaller. But never fear, a smaller percentage of a large number is still more money than a large percentage of a small number.

Check out the chart below to find your suggested total owner compensation. If you aren’t getting that, you might want to make some changes so that your firm becomes more profitable.

Total Owner Compensation Percentage based on Total Annual Revenue

Illustration ©iStockPhoto.com

Subscribe to Attorney at Work

Get really good ideas every day for your law practice: Subscribe to the Daily Dispatch (it’s free). Follow us on Twitter @attnyatwork.