Once you understand how to manage your law firm profits and track your total owner compensation, your final tax bill may hurt, but it won’t be such a jolt.

Table of contents

- ’Tis the Season for Tax Payments

- What Counts as Profit?

- How Should You Divide the Rest of Your Law Firm Profits?

- Total Owner Compensation Is the Number to Watch

- Four Ways to Manage Your Law Firm Profits

- More on End-of-Year Tax Implications for Law Firm Owners

- Read “From Panic to Profit” Tips on Law Firm Finances

’Tis the Season for Tax Payments

Lawyers are often caught off guard when the accountant comes to them in March or April and says, “You owe $$$$.” The question that goes through their head is, “How can I owe money if there wasn’t any cash left in my account at the end of the year?”

This is usually followed by some concern about where they are going to get the money.

Let’s focus on the first question: Why do you owe taxes when there wasn’t much cash left in the firm’s business account at the end of the year?

What Counts as Profit?

Total Profit is the number the Internal Revenue Service uses to calculate your annual taxes. Here is the equation for calculating your law firm profit on your year-end profit and loss statement.

We suggest looking at your profit number each month and setting aside a percentage of that money for taxes. The IRS is always going to get its pound of flesh, so you might as well plan for it.

Your tax accountant can tell you what percentage you should tuck away for tax payments, and when to make estimated tax payments throughout the year.

How Should You Divide the Rest of Your Law Firm Profits?

Once you set aside money for taxes, that leaves the rest of the profit to be divided. Part of your law firm’s profits needs to be segregated into an account set up as a “war chest,” while the rest gets distributed to the owner or owners.

And that’s a fine balance. There always seems to be one partner who wants to plow all the money back into the firm to grow, while another partner always wants to distribute all the profit. Neither is wrong — the answer is somewhere in the middle.

Filling the Firm’s War Chest

Your firm is probably the biggest asset and definitely the biggest wealth creator you have in your life. Having money sitting in an account, ready to deploy as opportunities arise, will help create that wealth.

If you work on contingency, you can use your war chest to fund cases. Another good use might be marketing initiatives. (Read “A No-BS Way to Tell If Your Marketing Is Working.”)

If you mostly work on an hourly basis, contingency cases that can secure your retirement probably only come along a few times in your career.

I ran my family’s law firm before I started my company — I was basically the CFO. My father had a few of these big contingency cases come along — it’s why he holds the highest jury verdicts ever awarded in multiple counties in Texas. As a corporate litigator. But financing those cases, which can take years — especially when you factor in all the appeals — is really hard. So, having cash in a war chest to cover the loss of hourly billing is huge.

And those huge cases bring me to what you do with the rest of the money.

Paying Out Law Firm Profits

We advise our clients to keep half the profit in their war chest and distribute the rest. Keep in mind that what gets distributed doesn’t show up on your P&L. Distributions pass through to the owners’ individual tax returns.

Especially with those big judgments, you need to take care of yourself and your family. Pull the money out of the firm and invest it. Use it for retirement.

That brings me back to my family’s story. When my father and brother won that big case and it paid out, they took cash OFF THE TABLE. It means my brother can retire — and he’s only 45. He has secured his future.

As the firm’s owner, you should be properly compensated for the time, energy and risk you put into it.

Read (“Building a Law Firm That Pays You First.”)

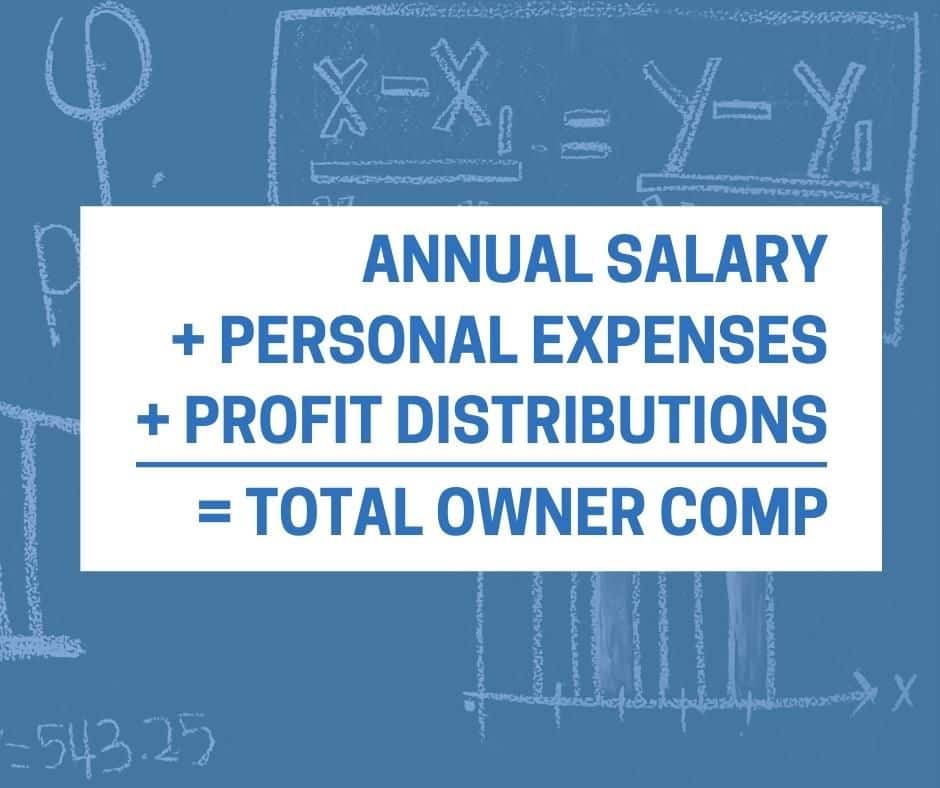

Total Owner Compensation Is the Number to Watch

Be aware that there is a difference between the profit you distribute and total owner compensation.

Total owner compensation is all the benefit you get from your firm — and that is the most important number.

Your total owner comp for the year is made up of a few categories:

- The salary you get for working in your firm.

- All the personal expenses you run through the firm. (No judgment, we all do it. As long as your CPA is fine with it, so are we.)

- Any profit that is distributed.

Read “The Best Law Firm Compensation Plans Follow the Rule of Thirds.”

Depending on the size of your firm, you want total owner compensation to be between 35% and 70% of firm revenue. See the chart below for exact percentages.

Are you getting that much? Do you even know?

OWNER COMP PERCENTAGE OF REVENUE

| Revenue Range | $ – to $250,000 | $250,000 to $500,000 | $500,000 to $1,000,000 | $1,000,000 to $5,000,000 | $5,000,000 to $20,000,000 |

| Owner Comp | 70% | 60% | 50% | 35% | 35% |

Four Ways to Manage Your Law Firm Profits

None of you opened your own firm or became a partner in an established firm to not make money.

Here are four things you can do to stay on top of your law firm profits and total owner compensation:

- Tax payments. Talk to your accountant and establish a reasonable percentage that should be put in a separate tax account based on the profit each month. That way, you are ready to write the check at tax time — no matter how big or small.

- War chest. Put an agreed amount of profit in a separate account, make a list of great uses of cash, and then marry up the two. (Read “Funding Growth: Are You Starving Your Law Firm?“)

- Distributions. Monitor your profit. Is it rising or falling? Does it satisfy your needs?

- Owner benefit. Do the math and figure out how much you are actually benefiting from your firm.

Keep your eyes on these four things, and next year, the tax-time news from your accountant won’t be such a jolt.

More on End-of-Year Tax Implications for Law Firm Owners

Law firms are often structured as pass-through entities — the firm’s profits pass through to the owners’ individual tax returns. This can result in a significant tax burden for law firm partners, especially if they have not been setting aside money throughout the year to cover tax liabilities.

Here are some tips to save on end-of-year taxes:

- Set aside money for taxes each month. Monthly or quarterly estimated tax payments will help avoid a large tax bill — and penalties — at the end of the year. Setting aside a percentage of income each month makes it easier to access funds.

- Take advantage of business deductions. There are a number of deductions that law firms can take advantage of, such as business expenses, health insurance premiums, and retirement plan contributions.

- Consider changing your structure. A financial advisor or tax advisor can help you determine whether changing your firm’s structure from a partnership or sole proprietorship to an LLC or corporation is a good move. While not always the right decision for every law firm, incorporating can offer some tax advantages, such as the ability to pay owners a salary and fringe benefits.

- Consult with a tax advisor. A tax advisor can also help law firms develop a tax strategy to minimize their tax burden.

Read “From Panic to Profit” Tips on Law Firm Finances

- What Should Be on Your Law Firm Dashboard

- Why You May Not Need a Lawyer in Charge

- The Best Law Firm Compensation Plans Use the Rule of Thirds

- A Simpler Bonus Structure for Associates, Paralegals and You

- Selling a Law Practice: Prep Your Law Firm — Even If You Don’t Want to Sell

- Everybody in Your Law Firm Needs a Production Number

- Are Your Law Firm’s Financial Systems Ready to Scale?

- 5 Ways You May Be Sabotaging Your Firm’s Growth

- Law Firm Overhead: What It Is — and What It Isn’t

Image © iStockPhoto.com.

Sign up for Attorney at Work’s daily practice tips newsletter here and subscribe to our podcast, Attorney at Work Today.

Illustration ©iStockPhoto.com

Subscribe to Attorney at Work

Get really good ideas every day for your law practice: Subscribe to the Daily Dispatch (it’s free). Follow us on Twitter @attnyatwork.