If you can’t easily understand exactly where your money goes, here’s advice from a law firm accounting expert on setting up your books so you get clearer reports.

Table of contents

Most small and solo law firms are working with financial statements that don’t give them the information they need to make informed business decisions.

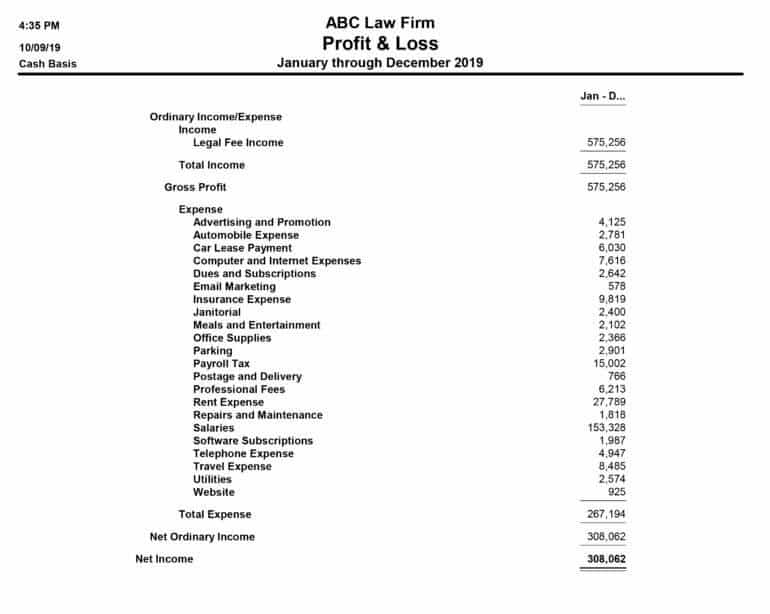

The Off-the-Shelf Law Firm P&L

To illustrate, I’ve created a mock P&L that exemplifies what I often see when I first look at a firm’s books.

In the profit and loss statement above — created using only the default QuickBooks expense categories — the bookkeeper has not customized the expense categories at all. Instead, she has used the standard chart of accounts provided by QuickBooks. (Instructions about how to modify your chart of accounts are provided at the end of this article.)

What a Standard QuickBooks P&L Won’t Tell You

Using the P&L above, can you answer the following questions about the two largest expenses for law firms — occupancy and personnel expenses?

- How much does this firm spend on personnel, all in (wages, workers’ comp insurance, employee benefits and other perks)?

- Similarly, how much does this firm’s office space cost them in total, including rent, utilities, janitorial, visitor parking?

Unfortunately, you cannot easily answer the questions using the information presented in the sample P&L. Indeed, not only can’t you answer the questions after a quick glance at the P&L, but you won’t even be able to answer them by spending a few minutes with the report and your calculator. This is because the default expense categories employed in this P&L are configured in a way that obfuscates that information. For example, the insurance line lumps together health insurance, workers’ compensation insurance, and E&O coverage. Thus, it effectively hides health insurance and workers’ comp costs.

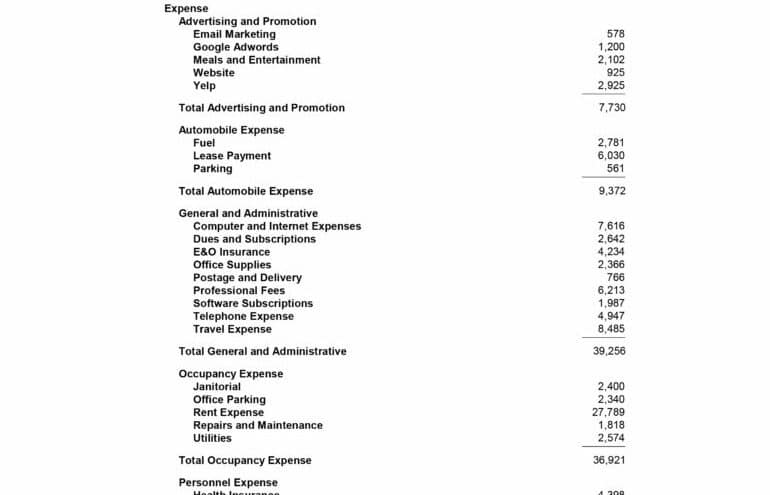

A Customized Law Firm P&L

In contrast, let’s take a look at another P&L — this one customized by me to provide the law firm’s principals with clear and meaningful information about its business.

Can you answer the questions (1) How much does the firm spend on personnel and (2) How much does the firm’s office space cost them? Yes! And you can answer them easily, with one quick look at the financial statement.

The reason is that the second example employs two simple strategies that organize the same expenses in a much more informative way:

- “Parent” accounts are created to organize similar expenses into broad and understandable categories.

- Insurance is divided into logical subcategories such as health and workers’ comp insurance (a personnel expense) and professional liability insurance.

These simple modifications to your accounting records are quick and easy, and they will give you a great deal of clarity, especially about the expenses your firm is incurring.

Law Firm Accounting Guidelines to Help You Do This for Your Own Firm

Start thinking about the broad categories of expenses you want to track. Whether you are using QuickBooks or another accounting program, I suggest the following:

- Personnel expense. If you have staff, you know that salaries are just one part of the true cost of employing people. As you’re setting this up, think hard about all the other ways you spend money on human capital. Did you use a search firm or recruiting website during your employee search? Are you paying benefits? All of these costs should be captured so that you can see the entire cost of your personnel.

- Occupancy expense. For most firms, this is the second-largest ongoing expense. Naturally, you’re going to place rent expense here, but don’t forget the other expenses you incur as a result of being in your particular space. Perhaps you have to pay the parking garage separately for employee parking, and for those pricey parking validation stickers. Do you have a janitorial service, a plant service, utilities? Include them. The rule of thumb is to ask yourself, would I still have this expense if I didn’t have this particular office?

- Advertising and promotion. This is probably the only line item that you’ll want to look at from a perspective of return on investment (ROI). Even if you’re not matching the precise income you’ve gained to each different advertising or promotional dollar you’ve spent, you’ll still want to look at this number closely. Subdivide this expense category in any way that makes sense to you. I have a client who has expense sub-accounts titled “Avvo,” “Google AdWords” and “Yelp” because he spends money each month on those services.

- Automobile expense. Most small and solo law firms run at least some of their automobile costs through the business as a way to maximize allowable tax write-offs. The reason to use subcategories here is to split out parking expenses and tolls, which are deductible at 100% percent. This will help your CPA during tax prep.

- General and Administrative. This broad category captures all the costs you incur in the running of your business that cannot be neatly pigeonholed into one of the other categories.

Insist on Clarity in Financial Statements

Your P&L statement should be tailored to your specific business needs. Don’t let your accountant or bookkeeper use generic expense line items. Instead, insist on clarity and usability in your financial statements. If you can’t easily understand exactly where your money goes, you need to revamp your books.

Extra: Click here to download PDF instructions on how to modify your QuickBooks chart of accounts.

1016 | Illustration ©iStockPhoto.com