“So that’s how you do that!” My article on handling retainers, ”Would You Pass a Trust Account Audit?,” generated a lot of inquiries and ah-hah moments. So, I’m following up with more tips on handling trust accounting transactions, focusing on settlements and the importance of having an experienced personal injury attorney to manage the process.

Table of contents

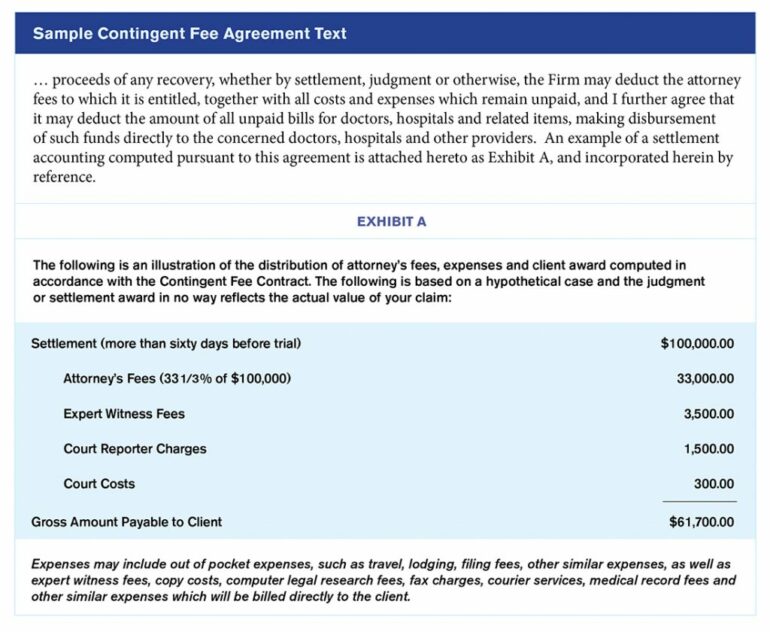

Best practices for handling settlement funds starts with a properly written and executed contingent fee agreement. This document should clearly communicate to the client how funds from a settlement check will be disbursed. In the case when a settlement is not reached and there is no settlement check for the client, the fee agreement should also explain what expenses or fees the client will be responsible for paying if any.

As an example, below is a sample of text that may be used in a contingent fee agreement.

Settlement Agreements

A settlement agreement is a contract that settles a personal injury case, outlining the terms of the settlement. This document will state the amount of money to be paid to the plaintiff and can be reached through negotiations or mediation. Make sure to have a personal injury lawyer review the agreement to make sure it’s fair.

- The amount

- Payment terms (when and how)

- Release of liability (the defendant is off the hook for your injuries)

A good settlement agreement will protect you and make sure everyone knows what’s expected.

Settlement Funds and Your Trust Account

Certain types of funds require special handling, and settlement funds fall into this category. The insurance company is typically responsible for issuing settlement checks following an agreement. Settlement funds are always deposited directly into your law firm’s trust account and are paid to parties of the settlement from the trust account. A settlement check is never directly deposited into your firm’s operating account. Depositing into the trust account serves as notice to the world that this money is not for you to use for regular business operations.

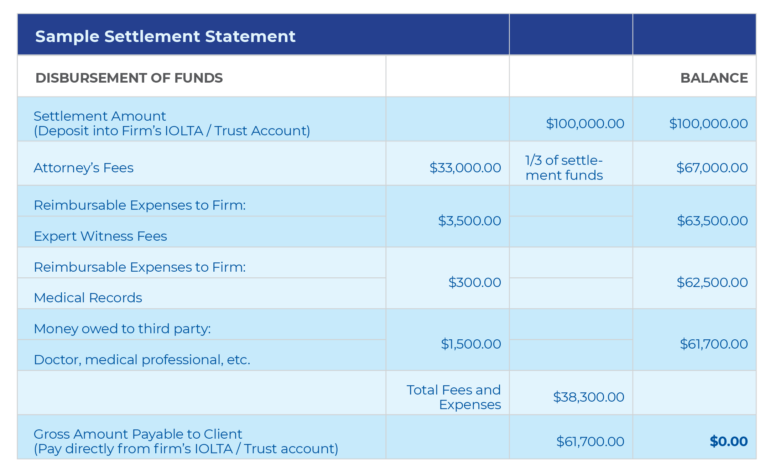

Here is an example illustrating a basic settlement statement.

Properly Tracking, Recording and Paying Settlement Transactions

You always want to review and follow your state’s particular ethics guidelines and procedures, but here is a general checklist, and some best practices, for handling settlements. Understanding the settlement check process is crucial, as it involves steps that ensure you receive your financial compensation without unnecessary delays.

Record and deposit the settlement check.

It can’t hurt to emphasize at the start of this checklist that you should never disburse funds until you have faithfully recorded and deposited the check — and made certain it has cleared. Understanding the process of settlement checks mailed, including the steps from the settlement agreement to the actual delivery, is crucial. That said, here are basic procedures:

- Get signatures. If the check is made out to both the client and the law firm, you need both signatures.

- On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.)

- Scan or copy the check and save a copy in the client’s file.

- Deposit the check into the firm’s trust account.

- If it is an electronic transfer of funds, save a copy of the verification of deposit.

Prepare a settlement agreement statement.

The settlement statement is your audit trail and it should be reviewed and signed by both the client and the lawyer. It defines the proposed disposition of the personal injury settlement check and should include the following:

- Total amount of the personal injury settlement check received and the payee.

- The amount payable to the firm for fees earned per the settlement agreement.

- The amount payable to the firm for expenses paid by the firm during the course of the representation.

- Any amounts payable to third parties, with copies of the invoices to be paid.

- Amount due to the client.

- Area for the client’s and the lawyer’s signatures.

Your practice management system or accounting software should be able to produce a report that lists all expenses incurred and paid by the firm on behalf of the client during the representation. Include a copy of this report with the settlement statement.

3. Write checks and receive payments for your portion of the settlement.

Once funds are available, you can write checks to all of the parties listed on the settlement statement. All funds get disbursed directly out of your trust bank account and recorded in the client’s trust account ledger. First, though, before your firm can be paid from the settlement, you need to prepare an invoice to the client for your fees and expenses, and then receive payment for it. That way, you can properly account for the revenue and expense recovery. A personal injury attorney plays a crucial role in managing the distribution of these settlement funds, ensuring all legal fees are deducted, and proper documentation is handled.

In your practice management system or accounting system, do this:

- Create an invoice for the firm’s portion of the settlement check showing fees earned and expenses paid during the representation.

- Write a check from your trust account, payable to your firm, to pay your invoice. On the check’s memo line, include the file or case number and client name.

- Next, “receive payment” on the above invoice in your system, making sure that you deposit the payment into your operating account and apply the money to the correct general ledger account(s).

Write other checks, completing the settlement statement:

- Write checks to third parties.

- Write a check to the client for the client’s portion of the settlement.

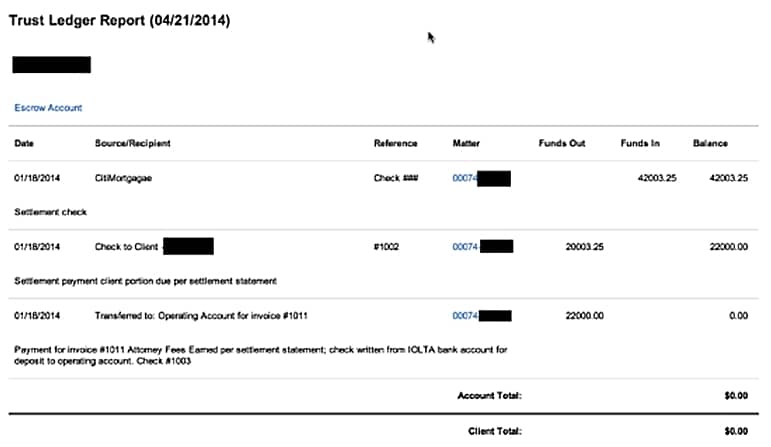

Next, run a client trust ledger report in your accounting system, showing all the transactions (deposits and checks written). The account balance should equal $0.00.

Note: When writing checks from settlement funds, be sure to go back to the settlement statement to record each check number there, then save a copy of it in the client’s file. (Ideally, your client files are electronic. Haven’t moved to paperless yet? Now is a good time to start.) This provides an additional audit trail.

4. Prepare final documentation and paperwork.

Lastly, the client should be sent the following items, via certified mail or delivered in person:

- Signed copy of the settlement statement.

- Signed copy of the settlement agreement.

- Copy of the client trust ledger report.

- Copy of invoice(s) prepared and marked paid.

- Check from the firm’s trust account for the client’s portion of funds.

Personal injury attorneys play a crucial role in facilitating the settlement process for personal injury lawsuits, ensuring all necessary documents are prepared and the settlement status is communicated effectively.

Now you should scan and save all of your final documentation in the client file.

Tip: A word of caution when the settlement check comes and you’re sitting with your client across the table from you. Don’t let the client persuade you to write their check for their portion of the settlement on the spot. Remember, the settlement check must get deposited into your trust account and the funds need to be available to withdraw. This may take two to three days, depending on your bank’s deposit rules and the amount of the check being deposited. Trust accounting has rules that need to be followed.

Delays and Problems

Settlements can be a quick fix to a personal injury lawsuit but delays and problems can happen. Here are some common issues:

- Disagreement on the Settlement Amount or Payment Terms: Parties can disagree on the settlement amount or payment terms and that will delay.

- Delay in Receiving the Settlement Check: Administrative or processing issues will delay the settlement check.

- Problems with the Settlement Check: Errors or omissions on the settlement check will cause more delays.

- Unforeseen Expenses or Liens: Additional expenses or liens will need to be paid out of the settlement funds and that will complicate things.

An experienced personal injury lawyer can help with that and make the settlement process as smooth as possible.

Pre-Settlement Funding

Sometimes plaintiffs need financial help while waiting for their settlement check. Pre-settlement funding companies can give a cash advance on the expected settlement amount so plaintiffs can pay their medical bills and outstanding medical bills.

Pre-settlement funding companies offer:

- No-Risk Funding: Plaintiffs only repay the loan if they settle.

- Easy Application Process: No credit checks or financial history required.

- Flexible Loan Options: Customized to the plaintiff’s needs.

But you should read the fine print of any pre-settlement funding agreement to make sure it’s fair and reasonable. Consult with a personal injury lawyer to get more guidance.

Personal Injury Lawyer

- Negotiate a Fair Settlement Agreement: Get the terms right.

- Ensure Proper Endorsement and Deposit of the Settlement Check: Handle the paperwork to avoid mistakes.

- Handle Disputes and Issues: Address any problems that come up during the settlement process.

- Pre-Settlement Funding Options: Advise on the best financial options.

When choosing a personal injury lawyer look for someone who has experience with personal injury cases, a good reputation and client satisfaction guarantee. That way you’ll have the best support for your personal injury case.

Settlement Funds: Settling Up

Follow this checklist and you’ll be ethically compliant with client settlement funds. A pre settlement funding company can also give you the financial help by taking the risk out of lawsuit loans and offering flexible funding options for the plaintiff.

Image © iStockPhoto.com.

Sign up for Attorney at Work’s daily practice tips newsletter here and subscribe to our podcast, Attorney at Work Today.